Attention: Busy professionals with LIMITed TIME

A Simplified System to Confidently Build and Grow Your Portfolio – No Day Trading, No Guesswork, No Overwhelm

Gain clarity, control, and confidence in under 1 hour a day—no need for complex strategies.

Disclaimer: This is an educational program, not investment advice. Stock market investments carry risks, and returns are not guaranteed. Please consult a SEBI-registered financial advisor before investing.

Are You Struggling to Build Wealth in the Stock Market?

If you’re a business professional or retail trader, you’ve likely faced these challenges:

Inconsistent Returns? 7 out of 10 investors struggle to achieve steady profits.

Stressful Guesswork? Hours spent researching stocks, only to doubt your choices.

Wasted Time? DIY investing takes 100+ hours a year, pulling you from what matters most.

You deserve a better way—one that’s simple, effective, and lets you invest with confidence and peace of mind.

Imagine a Path to Steady Financial Growth Without the Stress of “Guesswork Investing”

Did you know?

Many self-managed portfolios underperform due to emotional decisions and poor timing.

Most professionals unknowingly pay excessive advisor fees without seeing proportional returns

Conflicting financial advice often leaves busy professionals overwhelmed, leading to decision paralysis.

7 out of 10 investors fail to achieve consistent returns because they lack a structured investment plan.

👉 Click Below to Start Building Your Secure Portfolio Now!

Choose the Investment Approach That Actually Works in 2025 & Beyond

If you're ready to build lasting wealth, you have two options: stick with the "Old Way" or embrace the "New Way" to grow your portfolio with confidence.

Hey, I'm Nirav Gandhi!

I am an investor and wealth coach who understands the challenges of balancing a demanding career with personal finances.

For years, I faced the same frustrations you may be experiencing—confusing advice, risky strategies, and constant stress over market fluctuations.

Through years of trial and refinement, I developed a simplified system that brings clarity, control, and steady growth to busy professionals like you.

This program isn’t built on untested ideas or empty promises; it’s the result of proven strategies that work for real-world investors.

Who's This Perfect For

Business professionals

Executives & managers

seld-directed investors

business owners

entrepreneurs

high income earners

full-time home makers

part time traders

frustrated Day traders

A Proven Strategy, Inspired by Top Investors

This course will help you achieve consistent, disciplined growth without high-stress trading, based on principles used by renowned investors.

1-Hour Investment Framework

Manage investments efficiently, even with a packed schedule.

Reduced Complexity

A streamlined system that cuts through the noise.

Consistency Over Hype

Prioritizing steady, reliable returns without high-risk volatility.

INtroducing:

Peaceful Wealth Creation System

Use a Proven System to Eliminate Confusion and Build Wealth with Confidence

The Calm Investor’s Mindset

Master the art of goal-setting and disciplined decision-making to avoid emotional pitfalls and set a strong foundation for success.

The Calm Investor’s Mindset

Master the art of goal-setting and disciplined decision-making to avoid emotional pitfalls and set a strong foundation for success.

Streamlined Stock Selection

Learn a step-by-step framework to quickly identify high-potential stocks and create a focused investment strategy.

Perfecting Entry Timing

Discover how to time your stock entries with precision, minimizing risks and maximizing returns.

Perfecting Entry Timing

Discover how to time your stock entries with precision, minimizing risks and maximizing returns.

Practical Risk Management

Develop a personalized risk management plan to protect your portfolio and ensure consistent growth.

Tracking and Optimizing Performance

Create a system to track your portfolio’s performance, analyze results, and make data-driven adjustments for lasting success.

Tracking and Optimizing Performance

Create a system to track your portfolio’s performance, analyze results, and make data-driven adjustments for lasting success.

Market Context and Adaptability

Understand market phases and trends to adjust your strategy and stay ahead of changing conditions.

Mastering Key Indicators

Simplify technical analysis by mastering a set of essential indicators that save time and provide actionable insights.

Mastering Key Indicators

Simplify technical analysis by mastering a set of essential indicators that save time and provide actionable insights.

Building a Balanced Portfolio

Design a diversified portfolio that balances short-term gains with long-term stability, aligning with your financial goals.

Overcoming Emotional and Practical Obstacles

Develop techniques to stay disciplined and resilient during market fluctuations, ensuring long-term success.

Overcoming Emotional and Practical Obstacles

Develop techniques to stay disciplined and resilient during market fluctuations, ensuring long-term success.

Sustaining Growth and Building Legacy Wealth

Learn strategies to sustain your investment success over the years and create a lasting financial legacy for your family.

But this is not all…

When you sign up today, you'll also receive 3 exclusive bonuses (Worth ₹70,000/-) included with your order!

Bonus #1: Prosperity Pulse Indicator

Instantly spot market trends and high-potential stocks.

Bonus #1: Prosperity Pulse Indicator

Instantly spot market trends and high-potential stocks.

Bonus #2: Market Pulse Indicator

Gauge market direction and momentum to time your entries.

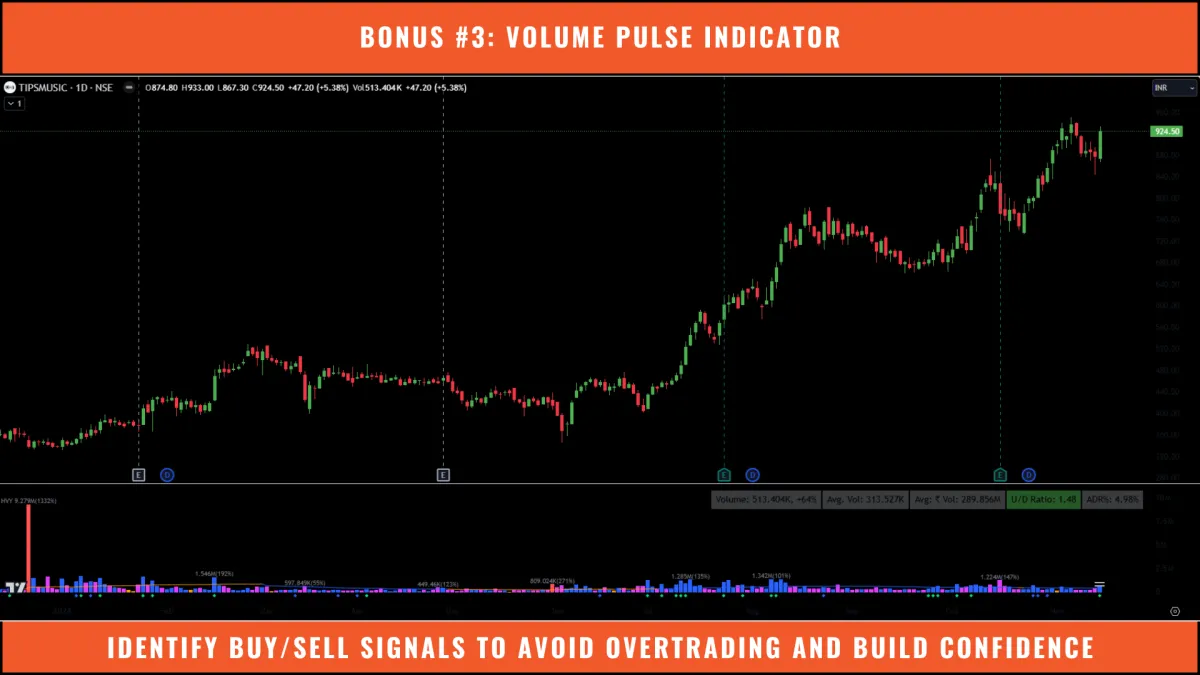

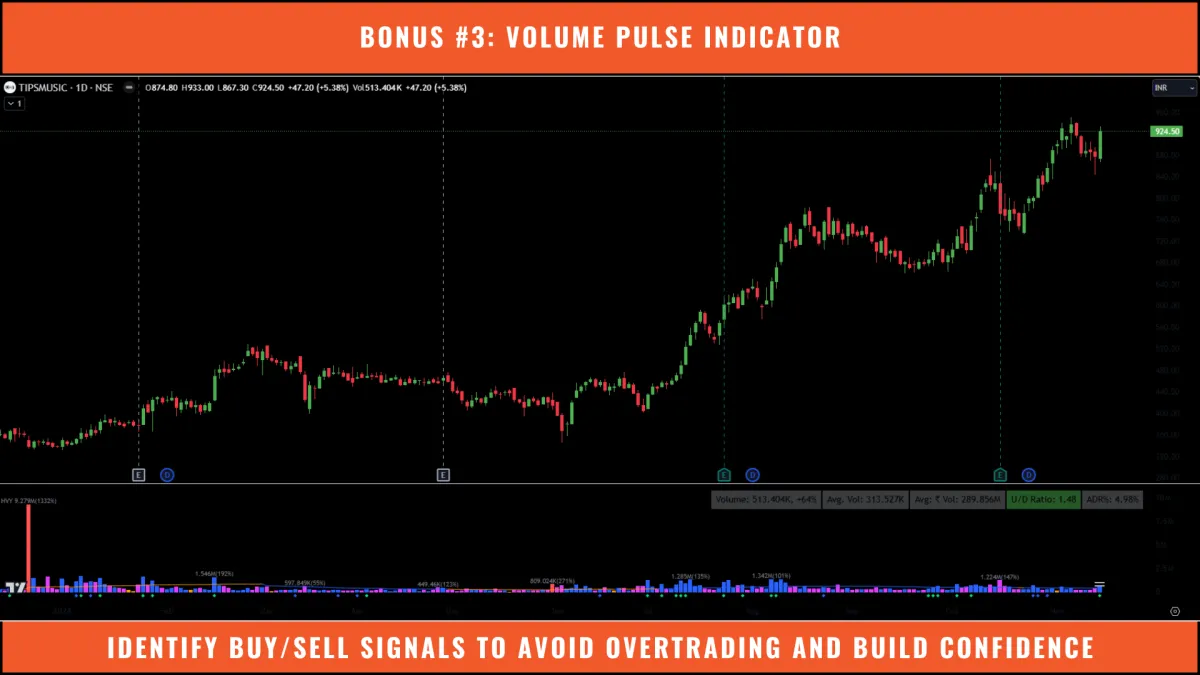

Bonus #3: Volume Pulse Indicator

Identify buy/sell signals to minimize overtrading and build confidence in your decisions.

Bonus #3: Volume Pulse Indicator

Identify buy/sell signals to minimize overtrading and build confidence in your decisions.

Your Solution for Low-Stress, Steady Financial Growth

Inspired by proven strategies used by successful investors, Peaceful Wealth Creation is designed for busy professionals who need clarity, low risk, and minimal time commitment.

Unlike overly complex systems or high-stress strategies, this program focuses on simplicity, discipline, and stability.

Imagine managing your investments in as little as

1 hour a day or 2 hours over the weekend — no complex analysis or constant market monitoring required.

What You’ll Get with Peaceful Wealth Creation

Our 10-module system empowers you with a streamlined approach to building wealth, step by step.

The Calm Investor’s Mindset (Valued at ₹15,000)

Streamlined Stock Selection (Valued at ₹15,000)

Perfecting Entry Timing (Valued at ₹15,000)

Practical Risk Management (Valued at ₹15,000)

Tracking and Optimizing Performance (Valued at ₹15,000)

Market Context and Adaptability (Valued at ₹15,000)

Mastering Key Indicators (Valued at ₹15,000)

Building a Balanced Portfolio (Valued at ₹15,000)

Overcoming Emotional and Practical Obstacles (Valued at ₹15,000)

Sustaining Growth and Building Legacy Wealth (Valued at ₹15,000)

Bonus #1: Exclusive Access to Three Custom-Coded TradingView Indicators (Valued at ₹70,000)

Prosperity Pulse Indicator: Instantly spot market trends and high-potential stocks

Market Pulse Indicator: Gauge market direction and momentum to time your entries

Volume Pulse Indicator: Identify buy/sell signals to minimize overtrading and build confidence in your decisions

Bonus #2: Lifetime Access to the Support Community (Priceless)

Original Price: ₹2,00,000

Yours today for only: ₹45,000

Pay a ₹10,000 deposit to secure your spot. Get 10 modules, 3 TradingView indicators, lifetime community access, & a free guide. Simplify stock selection, manage risks, & build wealth stress-free. Secure payment via Cashfree. Start your journey to confident investing today!

What Building This System on Your Own Would Really Cost

Doing this alone would cost you in time, energy, and money:

❌ Advisor fees: ₹3–5 lakhs+ over 10 years for inconsistent services

❌ Research time: 100+ hours per year, time that you could spend on your career or family

❌Custom indicators: ₹20,000+ if purchased separately

You want something that works NOW, not 12 months from now (or never)

When putting this together, I knew I wanted to keep it as affordable as possible.

So anyone could access these life-altering tools to rapidly achieve financial freedom and consistent investment growth.

That’s why I want to make the Peaceful Wealth Creation Program as accessible as possible to empower you with a proven system that saves time and delivers consistent results.

The reason I decided to do this is super simple...

My goal is to help more people, in less time, and the last thing I ever wanted was to be out of your price range with something so powerful.

The difference, however…

I’ve created something that, once understood……can be leveraged from the comfort of your home in just a few weeks to confidently grow wealth and achieve financial security—without me having to physically be there with you.

So for that reason alone, I’ve made this as affordable as possible.

✅Investing ₹45,000 in Peaceful Wealth Creation is not just smarter—it’s significantly cheaper than doing it all on your own. Gain a proven system, expert guidance, and time-saving resources in one place, and take control of your financial future.

What You’ll Get with Peaceful Wealth Creation

Our 10-module system empowers you with a streamlined approach to building wealth, step by step.

The Calm Investor’s Mindset (Valued at ₹15,000)

Streamlined Stock Selection (Valued at ₹15,000)

Perfecting Entry Timing (Valued at ₹15,000)

Practical Risk Management (Valued at ₹15,000)

Tracking and Optimizing Performance (Valued at ₹15,000)

Market Context and Adaptability (Valued at ₹15,000)

Mastering Key Indicators (Valued at ₹15,000)

Building a Balanced Portfolio (Valued at ₹15,000)

Overcoming Emotional and Practical Obstacles (Valued at ₹15,000)

Sustaining Growth and Building Legacy Wealth (Valued at ₹15,000)

Bonus #1: Exclusive Access to Three Custom-Coded TradingView Indicators (Valued at ₹70,000)

Prosperity Pulse Indicator: Instantly spot market trends and high-potential stocks

Market Pulse Indicator: Gauge market direction and momentum to time your entries

Volume Pulse Indicator: Identify buy/sell signals to minimize overtrading and build confidence in your decisions

Bonus #2: Lifetime Access to the Support Community (Priceless)

Original Price: ₹2,00,000

Yours today for only: ₹45,000

Pay a ₹10,000 deposit to secure your spot. Get 10 modules, 3 TradingView indicators, lifetime community access, & a free guide. Simplify stock selection, manage risks, & build wealth stress-free. Secure payment via Cashfree. Start your journey to confident investing today!

STILL NOT SURE?

Frequently Asked Questions

Have questions about our program? You're in the right place!

Is this course suitable for someone with limited investment knowledge?

Yes! The course guides beginners and experienced investors through a clear process that breaks down essentials without overwhelm

How much time will I need?

The program works well if you commit to 1 hour a day or 2 hours over the weekend to manage and review your investments.

What makes this program different from other investment courses?

Unlike high-risk trading or overly complex courses, this program focuses on low-stress, systematic strategies tailored to professionals with limited time. You’ll learn proven methods that deliver growth while minimizing effort and risk.

How is this different from high-fee advisory services?

Unlike advisors, this course empowers you to manage your investments confidently, eliminating recurring fees.

Will this program teach me day trading or F&O trading?

No, this program avoids high-stress methods like day trading and F&O trading. Instead, it focuses on long-term, low-risk strategies designed for sustainable growth and peace of mind.

How long will I have access to the program materials?

You’ll receive lifetime access to all program materials, so you can revisit the lessons and strategies anytime.

Is there any community support included?

Yes! You’ll gain lifetime access to our exclusive support community, where you can connect with like-minded professionals, share insights, and receive guidance.

What if I have questions or need help during the program?

You’ll have access to the support community and personalized resources to address any questions or challenges you face throughout your investment journey.

Copyright 2025 | Chatur Chacha - A stock market education initiative by Nirav Gandhi

We are on a mission to transform Indian Retail traders into Profitable Traders, helping them create wealth peacefully from the Stock Market. Chatur Chacha, or Nirav Gandhi is not a SEBI registered Research Analyst or a Registered Investment Advisor. Trading and investing in financial markets involves risk. The Peaceful Wealth Creation Program and all associated training materials are provided for educational purposes only. Past performance is not indicative of future results. We do not offer any guaranteed returns, investment advice, or portfolio management services. Please Be aware and stay away from anyone offering unrealistic returns or guaranteed profits from market related products. All trading decisions made by the student are their sole responsibility. Please consult with a SEBI-registered investment advisor before making any financial decisions. By enrolling in this program, you acknowledge and accept the inherent risks involved in the stock market.